IR-Medium-term Management Plan-

Medium-term Management Plan

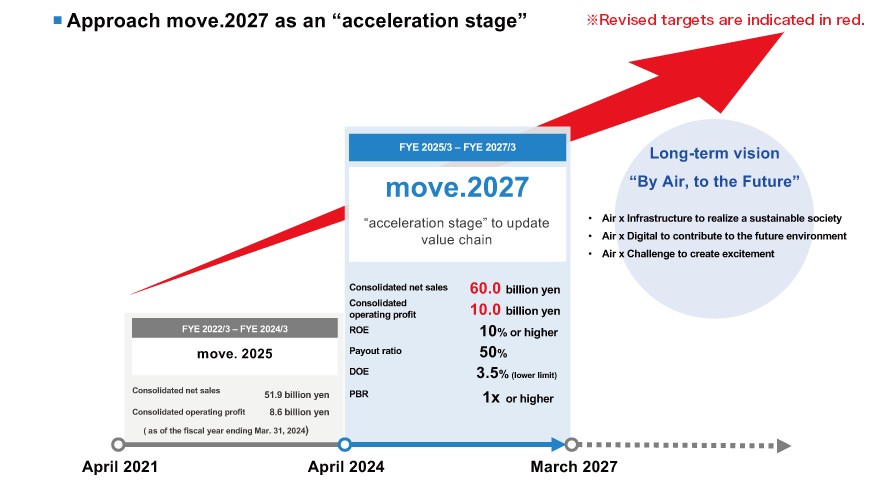

In November 2023, we announced a new Medium-term Management Plan.

※In May 2024, taking factors such as the favorable business environment at the time into consideration, we decided to keep strategic policy of “move.2027” and other business goals unchanged. However, we revised our target for the final fiscal year of March 2027, increasing our consolidated sales forecast by 4 billion yen to 60 billion yen, and our operating profit forecast by 1.4 billion yen to 10 billion

yen.

Medium-term Management Plan “move.2027” Materials and Scripts

move.2027 as an Acceleration Stage [P.2]

“move.2027” defines its three fiscal years as an acceleration stage to update the Group’s value chain. We will continue to take on challenges with the aim of realizing our long-term vision “By Air, to the Future.”

As for management targets, we aim for net sales of 60.0 billion yen and operating profit of 10.0 billion yen in the final year of the Plan. To achieve PBR of 1x or higher, we will promote management that is conscious of cost of capital and return on capital. We have also newly established a target for ROE of 10% or higher.

We will Promote management that is/with awareness of cost of capital and return on capital.

In addition, we will make significant enhancements to shareholder returns and bold reviews of our liabilities and equity structure. We have also set the target dividend payout ratio of 50% and the minimum DOE of 3.5%.

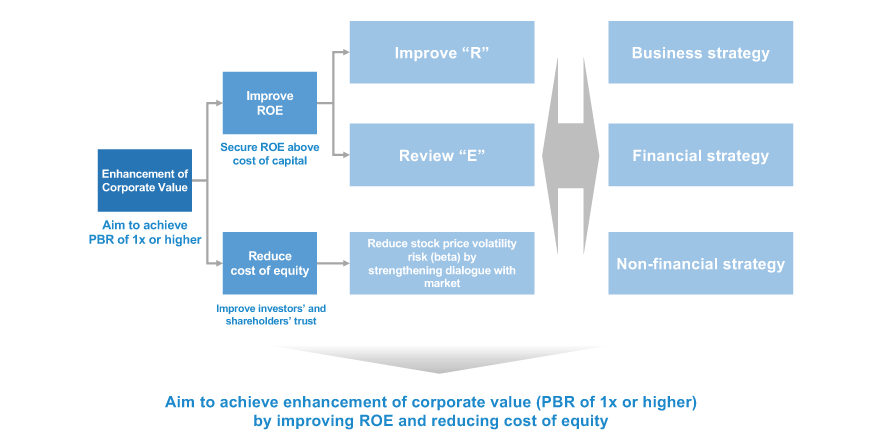

Toward Enhancement of Corporate Value [P.3]

Overview of the Group’s efforts toward enhancement of corporate value

To achieve PBR of 1x or higher, we will work to improve ROE and reduce cost of equity. To improve ROE, we will continuously improve return (R) and boldly review equity (E).

At the same time, we will strengthen dialogue with the market in order to facilitate better understanding of our value creation stories, which will grow trust of investors and shareholders in us and ultimately reduce stock price volatility risk.

To achieve these goals, we will implement our business strategy, financial strategy, and non-financial strategy in “move.2027.”

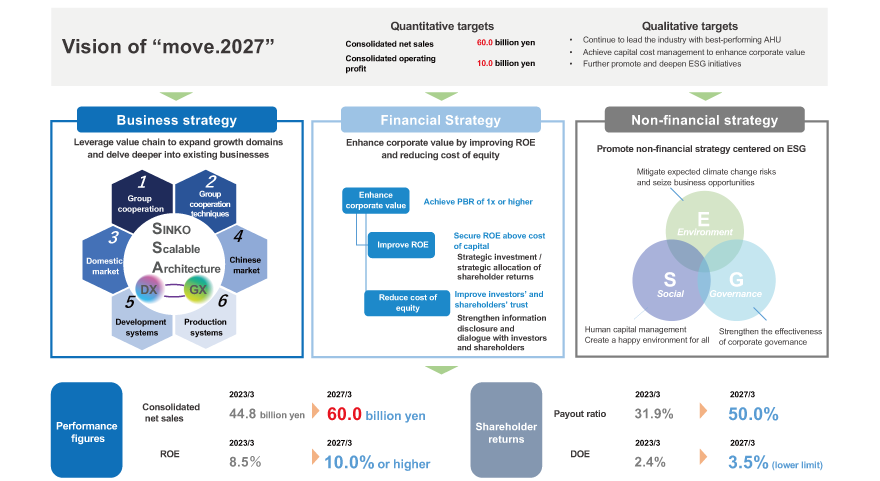

Vision, Strategies, and Targets of “move.2027” [P.4]

In addition to the quantitative targets, we will aim for the following three qualitative targets:

- Continue to deliver reliability and satisfaction to customers by providing best-performing products and services

- Achieve capital cost management to enhance corporate value

- Further promote and deepen ESG initiatives

We have pursued higher quality products and services to ensure that customers experience profound reliability and satisfaction.

We will continue to offer the best-performing, number one products and services that will contribute to the solution of various issues, including decarbonization, to maximize customer satisfaction.

Furthermore, we will continue to pursue the enhancement of corporate value through exciting endeavors, such as developing leading-edge technologies, creating new products and services with high added value, and expanding into new markets.

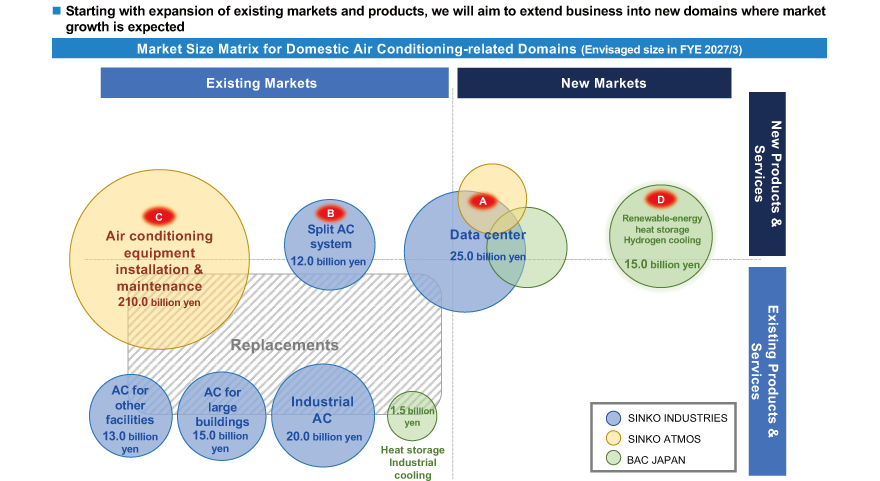

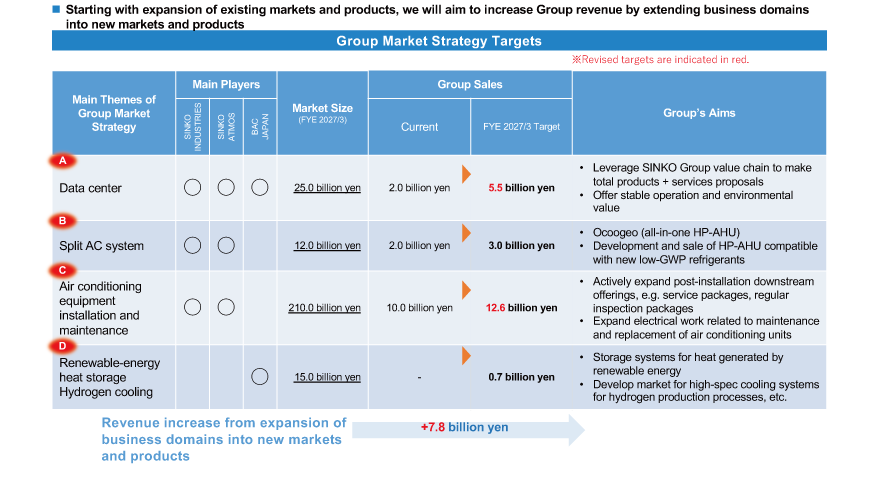

Medium-term Business Strategy Target Markets [P.5]

Target markets for the realization of strategies to grow our business

In addition to strengthening existing markets, we will focus mainly on four targets in new products, new services, and new markets.

* Blue circles: SINKO INDUSTRIES, core company in the group

Orange circles: SINKO ATMOS, the company in charge of air conditioning equipment installation and maintenance

Green circles: BAC JAPAN, the company that sells cooling systems and heat storage systems

A) Air conditioning systems for data centers, primarily hyper-scale data centers

B) Heat pump-type air conditioning systems for split AC system

C) Air conditioning equipment installation and maintenance

D) Heat storage systems for renewable energy and cooling systems and other equipment necessary for hydrogen energy carriers

Medium-term Business Strategy Major Group Market Strategy [P.6]

In these four target markets, we aim to increase revenue by 7.8 billion yen by the fiscal year ending March 31, 2027.

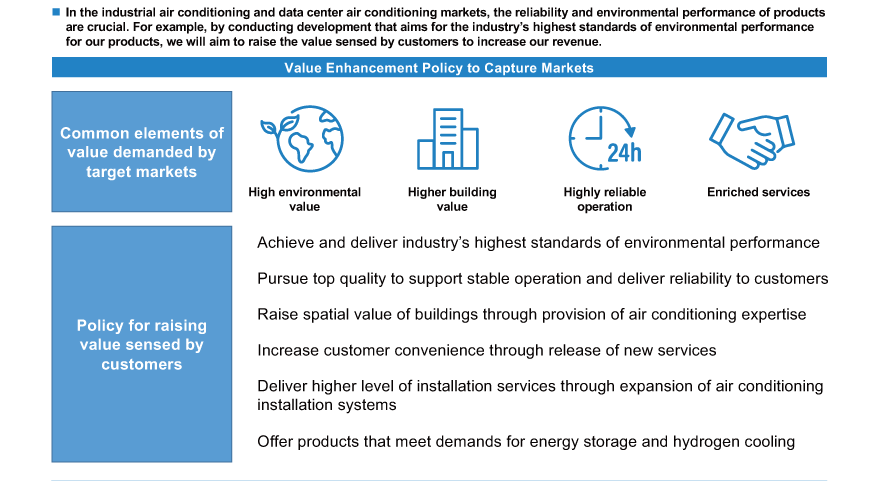

Deliver Reliability and Satisfaction to Customers [P.7]

Common elements of value demanded by target markets and our strengths

Value expected of air conditioning products and services is high environmental value, contribution to decarbonization, extra building value added by air conditioning, highly reliable operation, and enriched services.

The reliability and environmental performance of products are crucial. For example, by conducting development that aims for the industry’s highest standards of environmental performance for our products of industrial air conditioning and data center air conditioning, we will aim to raise the value sensed by customers to increase our revenue.

Furthermore, we will deliver top quality products and services to support stable operation of our air conditioning systems, which are proven by an excellent track record, and contribute to stabilizing operation and maintaining performance with reliable and prompt response to maintenance needs. We will thus work to increase customers’ sense of reliability and satisfaction with our products and services.

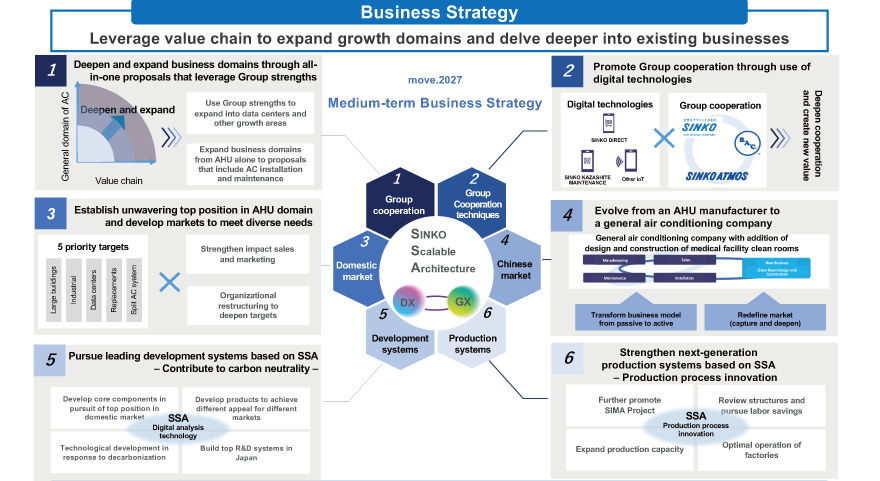

Overview of Business Strategy [P.8]

The core of our business strategy is to continue creating value to customers through best-performing products and the know-how we have accumulated, leverage value chain to expand growth domains, and delve deeper into existing businesses.

We will integrate the SIMA project, which we worked on in “move.2025,” with new analytical technologies, develop it further, and pursue it as SINKO SCALABLE ARCHITECTURE (SSA).

To be specific, it is comprised of six measures:

1) Deepen and expand business domains through all-in-one proposals that leverage Group strengths

2) Promote Group cooperation through use of digital technologies

3) Establish unwavering top position in AHU domain and develop markets to meet diverse needs in the domestic market

4) Evolve from an AHU manufacturer to a general air conditioning company in the Chinese market

5) Pursue leading development systems based on SSA ‒ Contribute to carbon neutrality ‒

6) Strengthen next-generation production systems based on SSA ‒ Production process innovation

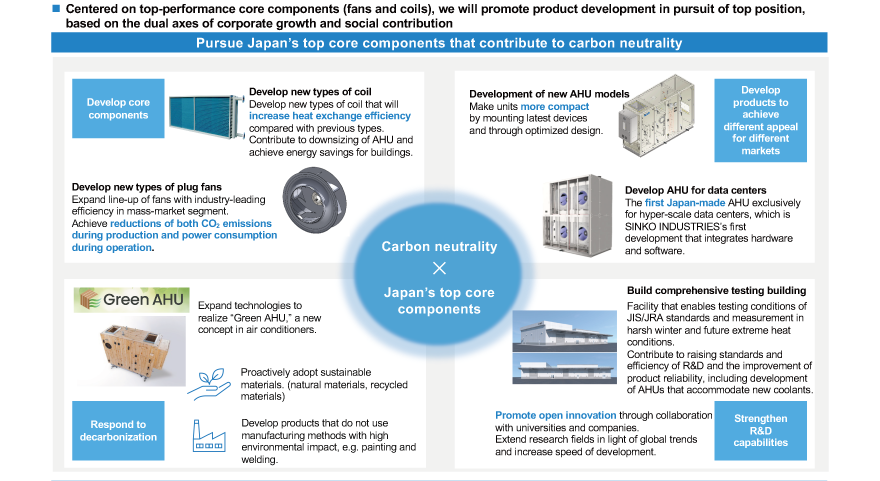

5. Pursue Leading Development Systems Based on SSA ‒ Contribute to Carbon Neutrality ‒ [P.9]

Pursue Leading Development Systems Based on SSA ‒ Contribute to Carbon Neutrality ‒

Centered on top-performance core components, we, as a longstanding leader in the industry, will promote product development in pursuit of top position, based on the dual axes of corporate growth and social contribution.

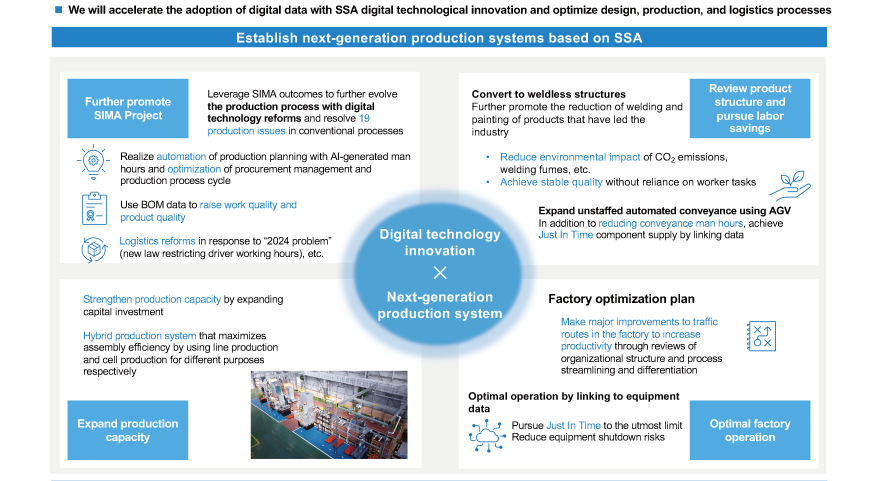

6. Strengthen Next-generation Production Systems Based on SSA – Production Process Innovation [P.10]

Strengthen Next-generation Production Systems Based on SSA – Production Process Innovation

We will accelerate production process innovation through the SSA digital reforms, review product structure, and pursue labor savings.

We will also work to expand production capacity and optimize factory operation.

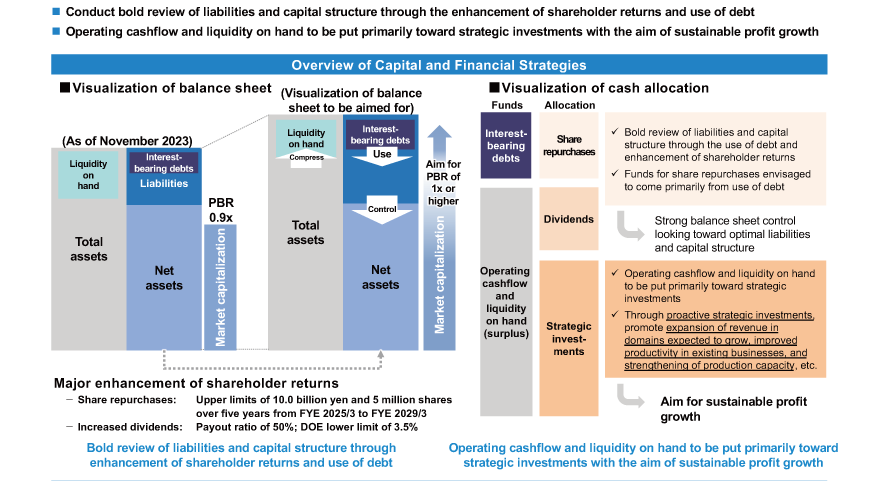

Overview of Capital and Financial Strategies [P.11]

Overview of Capital and Financial Strategies

We will perform a bold review of our liabilities and capital structure through the enhancement of shareholder returns and use of debt.

As the targets for shareholder returns, we have set the target dividend payout ratio of 50% and the minimum DOE of 3.5%.

We will buy back our own shares valued at 10.0 billion yen over the next approximately five years. The share repurchase will be funded by corporate bonds or borrowings.

Cash, including cash generated by debt financing, will be allocated to shareholder returns and strategic investments.

We will not merely return profit to shareholders but make solid strategic investments and aim for continuous profit growth.

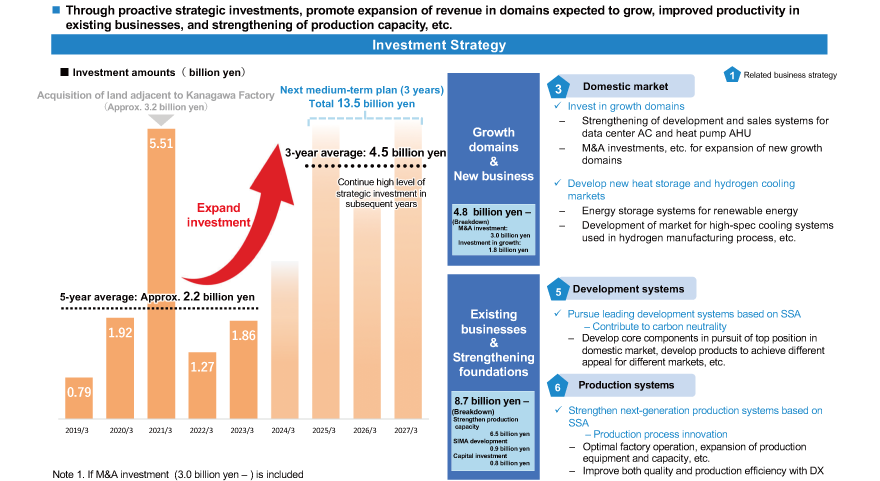

Investment Strategy [P.12]

Investment Strategy

Through proactive strategic investments, we will promote expansion of revenue in domains expected to grow, improved productivity in existing businesses, and strengthening of production capacity, etc.

We plan to invest 4.8 billion yen in growth domains and new businesses , 8.7 billion yen in strengthening foundations of existing businesses, which will total 13.5 billion yen in the period of three years.

Primarily, we expect to invest 6.5 billion yen in strengthening production capacity, 0.9 billion yen in SIMA development, and 0.8 billion yen in capital investment as well as 1.8 billion yen in growth domains.

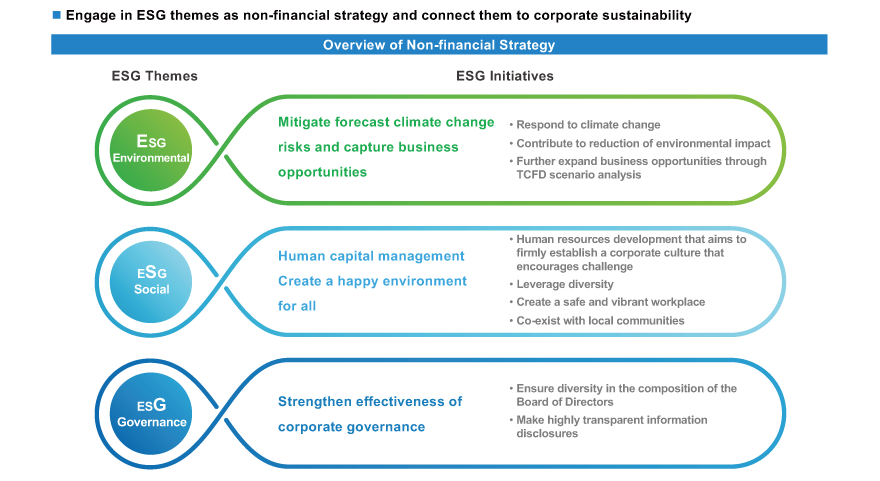

Overview of Non-financial Strategy [P.13]

Our non-financial strategy is to promote and deepen our ESG initiatives.

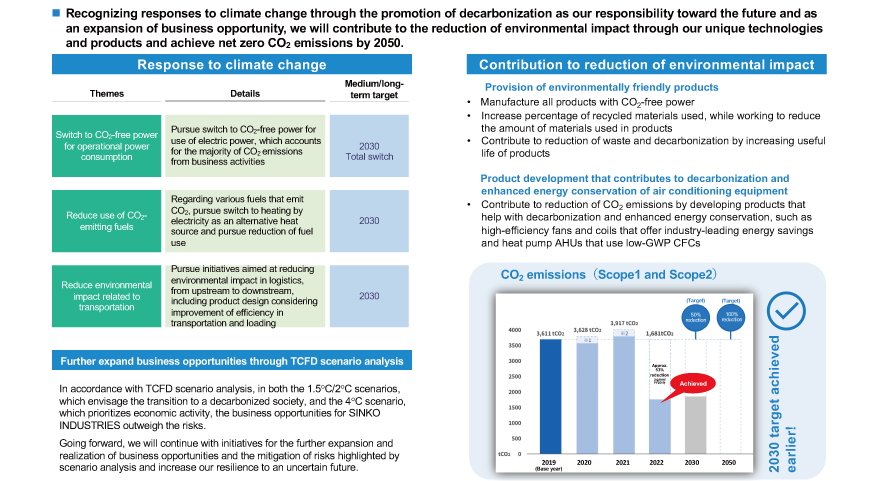

Environmental (E): Mitigate Forecast Climate Change Risks and Capture Business Opportunities [P.14]

Environmental (E): Mitigate Forecast Climate Change Risks and Capture Business Opportunities

Recognizing responses to climate change through the promotion of decarbonization as our responsibility toward the future and as an expansion of business opportunity, we will contribute to the reduction of environmental impact through our unique technologies and products and achieve net zero CO2 emissions from our business activities by 2050.

We have already started switching to CO2-free power and will work to reduce the use of CO2 emitting fuels and the environmental impact in logistics.

Through the growth of the sale of our air conditioning equipment, we aim to contribute to the reduction of environmental impact and decarbonization across the entire society and expand our business opportunities.

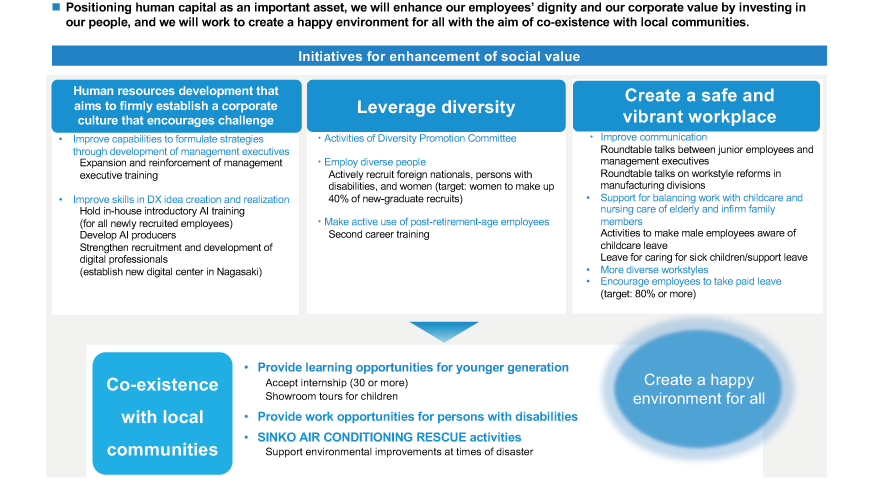

Social (S): Human Capital Management / Create a Happy Environment for All [P.15]

Social (S): Human Capital Management / Create a Happy Environment for All

Positioning human capital as an important asset, we will enhance our employees’ dignity and our corporate value by investing in our people through the following initiatives, and we will work to create a happy environment for all with the aim of co-existence with local communities.

- Human resources development that aims to firmly establish a corporate culture that encourages challenge

- Leverage diversity

- Create a safe and vibrant workplace

Governance (G): Strengthen Effectiveness of Corporate Governance [P.16]

Governance (G): Strengthen Effectiveness of Corporate Governance

We believe that it is important to ensure diversity on the Board of Directors, which is at the top of our governance.

We will appoint individuals from within and outside the Company to the Board in a manner that will enhance the Board’s skills map, which has already been disclosed.

To facilitate constructive dialogue with employees, shareholders, and other stakeholders, we will publish an integrated report and prepare an English version of the new Medium-term Management Plan.

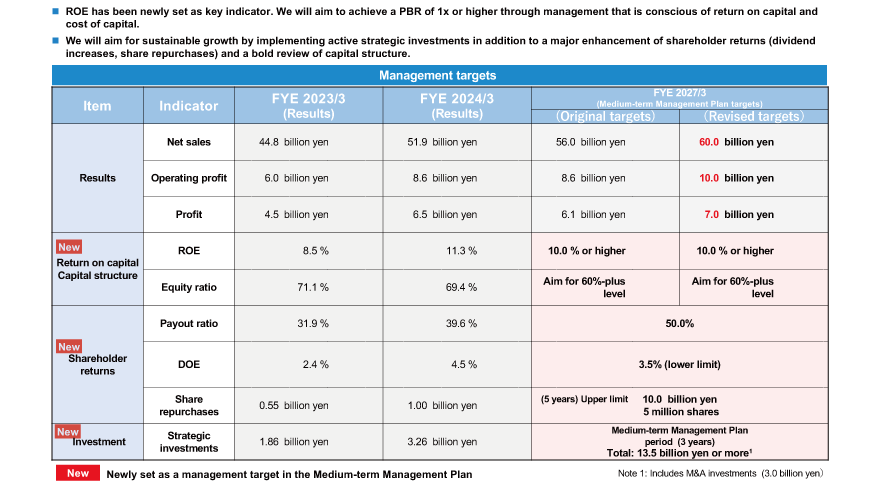

Management Targets [P.17]

Management Targets

ROE has been newly set as key indicator. We will aim for sustainable growth by implementing active strategic investments in addition to dividend increases and share repurchases as means of a major enhancement of shareholder returns and a bold review of our capital structure.

Additionally, In May 2024, taking factors such as the favorable business environment at the time into consideration, we decided to keep strategic policy of “move.2027” and other business goals unchanged.

However, we revised our target for the final fiscal year of March 2027, increasing our consolidated sales forecast by 4 billion yen to 60 billion yen, and our operating profit forecast by 1.4 billion yen to 10 billion yen.